How insurance companies can sometimes foster "second best" treatments?

Dentists whose patients have dental insurance can sometimes feel stuck between a rock and a hard place. Insurance plans commonly cover some procedures, and some, not so much. For example they are likely, after an endodontic procedure, to authorize a post and core, while rejecting a less expensive composite core. This certainly incentivizes dentists to place and more posts and cores than are actually needed. While this is a valid treatment to help restore a tooth after root canal, it not only is more expensive but may expose patients to more negative outcomes as well. Placing posts where they are not absolutely needed will put the patient at greater risk for endodontic failure ( due to the drill disturbing the seal of the guttapercha at the apex) , root perforation, or even eventual root fracture. Due to what I perceive as their increased risk, I try to avoid placing posts in teeth that have sufficient tooth structure remaining to retain a core. That being the case, performing a covered procedure may be more beneficial to a patient than not doing anything at all.

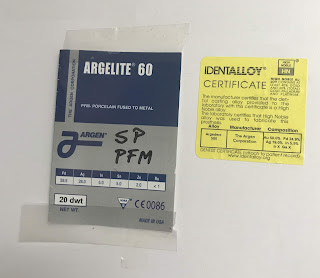

Another example is cosmetically restoring a dark anterior tooth after endodontic treatment. While insurance companies are likely to approve a post and core and crown for such a tooth, they may baulk at approving a porcelain veneer, even if this procedure in my opinion is better because it ensures that the cingulum of the tooth ( the area on the lingual of the tooth that meets the gingiva) is kept intact. This probably will actually make an incisor more resistant to subsequent fracture than a post and crown may. They may reason that the veneer is being done for "esthetic'' reasons and shouldn't be approved. They may have a point, since the reason the veneer is being placed is to often to mask an excessively darker tooth. That being the case, it doesn't usually stop the insurance company from authorizing a post and core and a crown in most instances.

It seems somewhat perverse to me, for insurance companies to authorize more expensive treatment plans that maybe less desirable for most patient. The way that insurance companies view some of these matters seems outdated and the procedures that they are denying are not "new" experimental treatments, but are mainstream choices. This can lead to dentists performing second best and more expensive treatments since their patient will not pay additional out of pocket costs for better procedures not covered by their insurance plan. Their dentist may correctly reason that a "second best" type of treatment is better for a patient than doing nothing at all.

from Ask Dr. Spindel - http://lspindelnycdds.blogspot.com/2018/07/how-insurance-companies-can-sometimes.html - http://lspindelnycdds.blogspot.com/

Comments

Post a Comment