Dental Insurance FAQ: The Basics

Dental Insurance

Dental insurance is an excellent investment that helps Las Vegas residents ensure a lifetime of healthy smiles. However, in order to get the best value from your dental insurance, there are a few things you need to know. Here are the answers to the most common questions we hear at Wagner Dental.

What is Dental Insurance?

Having dental insurance means that an insurance provider will pay for a percentage of the dental care that you need every year. Plans vary in terms of how much they cost, how much they cover, and which dentists are included. If you would like to know if Drs. Wagner, Cannon, Lawler, and Nelson are included in your provider network, please contact Wagner Dental today.

What Do Dental Insurance Plans Cover?

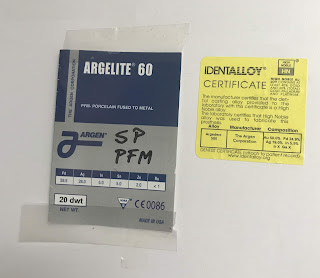

Insurance carriers cover dental procedures in three fundamental categories: preventative (examinations, routine cleanings, x-rays, etc.); basic/restorative (cavity fillings, tooth extractions, etc.); and major (crowns, bridges, surgical extractions, dental implants, etc.). The classification of procedures into categories varies according to each insurance carrier, but most dental insurance plans have “100-80-50” coverage, which means routine cleanings, checkups, and diagnostic care are paid for in full; 80 percent of the cost of fillings, root canals, and other basic procedures are covered; and 50 percent of the cost of dental implants and other major procedures are covered. Cosmetic dental procedures, such as whitening treatments, are not usually covered.

What are Premiums, Copayments, Deductibles, and Maximums?

- Premiums – These are the basic yearly or monthly cost of your dental insurance. Premiums do not include copayments or deductibles.

- Copayments – Per visit payments of a flat rate or a percentage of the total appointment cost.

- Deductibles – For each plan, there is an annual amount that you must pay before insurance will cover expenses. After your deductible is met, your insurance plan will cover a percentage of the cost of your dental care.

- Plan maximums – Most plans include a maximum dollar amount that will be paid for your dental expenses. You are financially responsible for any amount exceeding your plan maximum.

When Do Benefits Renew?

Benefits are usually calculated yearly and renew on the 1st of January. It is important to know that unused coverage does not carry over to the next year.

If you have specific questions about your dental insurance, you can contact your insurance provider directly or contact Wagner Dental today! We are always happy to answer any questions that help keep Las Vegas smiles beautiful and healthy.

Sources

http://www.humanadental.com/tools/faqs.asp

http://www.bankrate.com/finance/insurance/dental-insurance-1.aspx

http://www.ehealthinsurance.com/content/health/Dental-Insurance-FAQ.shtml

The post Dental Insurance FAQ: The Basics appeared first on Wagner Dental.

from Wagner Dental http://wagnerdentist.com/dental-insurance-faq-the-basics/

Comments

Post a Comment